Buying and selling is trading at its most fundamental. It determines your profit, and the price of an asset at any given time.

As we covered in the Introduction to financial markets course, the number of buyers (or bulls) versus the number of sellers (or bears) in a market at a given time will directly impact its price.

If lots of people are trying to sell an asset, then supply will outstrip demand, and its price will fall. If most traders are trying to buy, on the other hand, demand exceeds supply, and its price will rise.

But buying and selling isn’t just how prices are set – it’s also an essential part of everyday dealing.

- Buying and selling in trading

- Bid and ask prices

- What is the spread?

Buying and selling in trading

The fundamental principle behind any trade is to make a profit, which is determined by the difference between your opening and closing price.

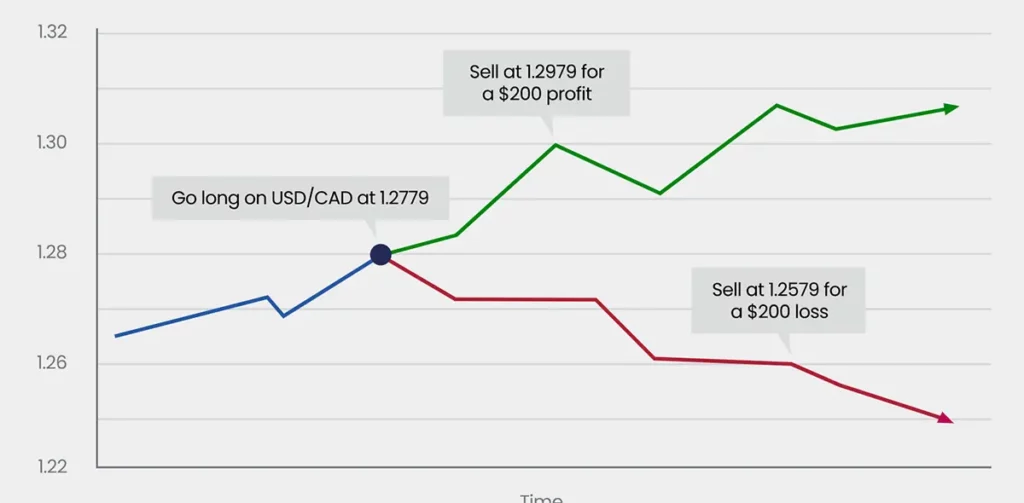

Let’s say you decide to buy USD/CAD, which is currently at 1.2779.

USD/CAD then rises to 1.2979, meaning the US dollar has strengthened in value against the Canadian dollar. Your profit or loss is based on how much USD/CAD moved: in this case, 200 points. If you’d bought 10,000 USD/CAD, you’d make a $200 profit.

However, if USD/CAD fell 200 points, you would lose $200 from the trade.

FXUS-SC9-BuyingAndSelling1

Bid and ask prices

Whenever you view a financial market, you’ll see two prices listed. The price on the left is the bid and the price on the right is the ask (sometimes referred to as the offer).

When you sell, you trade at the bid

When you buy, you trade at the ask

FXUS-SC9-BidAndAsk1

The bid will always be lower than the current market price, while the offer will always be higher.

What is the spread?

The spread is the difference between the bid and the ask prices, and is an important thing to when calculating your profit or loss from a trade.

Let’s use another example. When EUR/USD is at 1.1259, it might have a bid of 1.1257 and an ask of 1.1260. So, to buy the EUR/USD, you would open at 1.1260.

You would need EUR/USD bid price to move above 1.1261 before you can earn any profit from your trade. If EUR/USD moves up 2 pips to 1.1261, but its bid is 1.1259, then you would still sell at zero profit or loss.